The Argus Group Restructures Balance Sheet to Position for Future Growth - Argus Malta

- About Us

- Argus News

- The Argus Group Restructures Balance Sheet to Position for Future Growth

The Argus Group Restructures Balance Sheet to Position for Future Growth

Hamilton, Bermuda (July 20, 2018) - Against a backdrop of market uncertainty caused by global change and a low growth Bermuda economy, the Argus Group is today reporting an $18.6 million net loss attributable to shareholders. This was caused by a large number of major medical claims and actions taken to complete the restructure of the Group's balance sheet.

Alison Hill, Chief Executive Officer of the Argus Group, says: "My job is to deliver long-term sustainable value to shareholders, customers, staff and community. Uncertainty in global geopolitics continues to drive economic challenges around the world. This in turn drives caution from consumers, reduces spending and further exacerbates economic constriction.

"In most developed nations, rapidly ageing population coupled with declining birth rates impacts economic growth, and despite health education initiatives in most nations around the world, chronic disease continues to rise, bringing with it a plethora of health issues. In all of the territories in which we do business, we find that economic challenges, demographic changes and the healthcare system are having a profound impact.

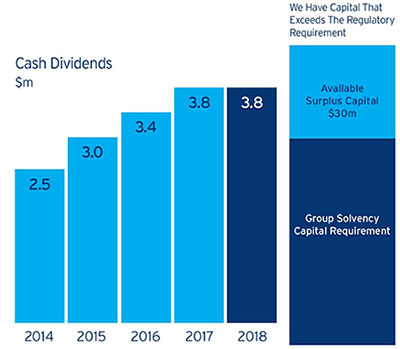

"However, our actions to de-risk the balance sheet have placed us in a strong financial position, validated by AM Best who in December 2017 upgraded the Group's financial strength rating to A- Excellent. The rating upgrade reflected the Group's appropriate enterprise risk management framework, consistent favourable operating performance and the strength of our balance sheet. We have continued our balance sheet optimisation strategy during the year with the sole focus of putting our capital to its best use while ensuring long term sustainable value. We are pleased that our diligent capital planning means that, despite our reported loss for the current year, the Group remains in a healthy capital position and we are able to sustain our dividend to shareholders at 9 cents per share.

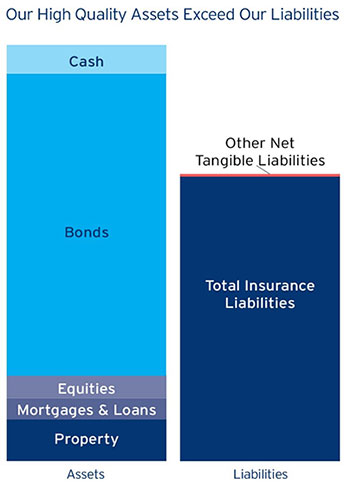

"At the core of the Group's investment philosophy is our commitment to careful and diligent custodianship of policyholder and shareholder assets. The Group's investment portfolio is designed to ensure funds are readily available to satisfy our obligation to policyholders and to enhance shareholder value by generating appropriate long-term risk-adjusted yields. We have a clear objective to maximise returns without taking inappropriate levels of risk. Consistent with last year, 84 per cent of the Group's investments are fixed income bonds of which 98 per cent are classified as investment grade."

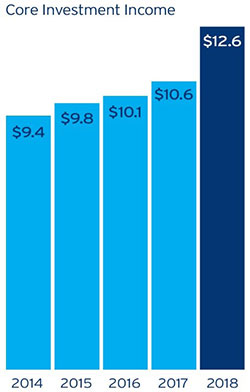

The Group's portfolio generated positive returns over the fiscal year, despite a number of events that have impacted global investment markets. The US Federal Reserve raised short-term interest rates three times. After a period of tightening credit spreads and rallying global equities, fears of inflation and trade wars caused significant volatility towards the end of our fiscal year. The Group continues to partner with best-in-class fixed income managers who have exceeded their benchmark returns for our major portfolios.

It is well known that within the Group's surplus investments we hold a number of non-core assets that had been accumulated over many years. These assets are generally illiquid, difficult to value, time consuming to manage and have been a drag on the Group's economic performance. Alison Hill says: "Against this backdrop, this year we committed to a decisive course of action to position ourselves to exit these non-core assets and redeploy the proceeds to generate profitable growth, and improve long-term shareholder value. Exiting these assets frees-up resources and creates additional liquidity that can be used to drive further diversification and growth. These decisions have not been made lightly; after an exhaustive process to explore and evaluate the various options it's clear that now is the time to implement our strategy. The impact of the resultant write-downs on our reported results is significant, totalling $19.5 million, but we're confident that our actions will improve long-term value to our shareholders.

"Subsequent to the year-end we were delighted to sign an agreement to sell our private placement life business. This non-core business segment had been a drag on Group resources for many years, and we look forward to being able to redirect these resources to support profitable growth and diversification. The terms of the deal will mean a gain of up to $6 million will be reported over the next three years, based on the persistency of the business. The transaction is subject to receipt of all required regulatory approvals and expected to be completed prior to September 30, 2018.

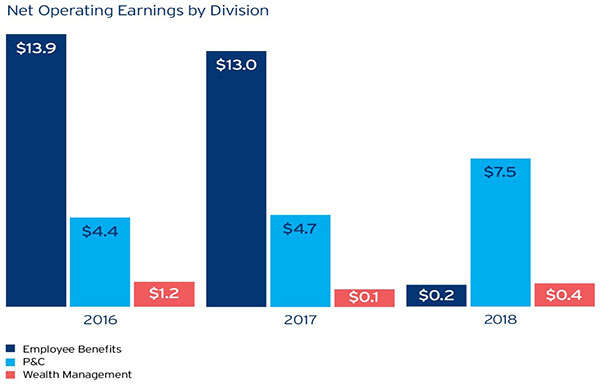

Argus operates within three core divisions; Employee Benefits, Global Property & Casualty and Wealth Management. The operating results from these three divisions, whilst lower this year, continue to be positive.

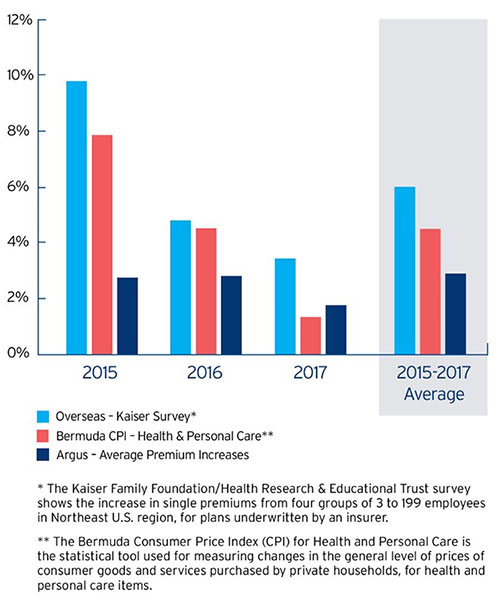

Within our Employee Benefits division in Bermuda, health insurance has been a profitable, albeit low margin, line of business for several years. Similar to many other developed nations, the cost of healthcare has risen well in excess of the general cost of living. The reasons for this are varied and complex, but include the prevalence of chronic disease, the continued introduction of new and expensive medical procedures, and the easy access to healthcare.

In 2015 and 2016 we saw what we hoped to be the start of a plateauing trend in health claims inflation. True to our philosophy we communicated this to our clients and held annual premium rates well below long-term health cost inflation. In 2017 and into 2018 we've seen health claims inflation revert to be more consistent with the longer-term trends. Health insurance is not without risk, and in a business where underwriting margins are tight, large major medical claims can also have a big impact on reported profits. Major medical claims generally occur when our members need us most: for example, over the past year, we've seen an unusually high number of difficult pregnancies and premature babies — and we are steadfast in our commitment to our members to ensure seamless access to the very best available healthcare. This has played out in our financial results, where claims within our Health business were $10.4 million greater than in the prior year.

With the benefit of hindsight, we passed on premium savings to our customers too quickly, which has contributed to the loss in our health business this year. However, we have acted decisively and have several initiatives in place to return our health business to sustainable profit.

Our Pensions business continues to grow our fee based income from increased assets under management, driven by strong investment returns and new business, particularly in the international business sector. In 2018 we have invested heavily in market leading technology to enhance our digital customer experience for our pension clients and members. We're pleased that the changes we made to our pension fund offering in 2017 are delivering the returns we expect. We remain concerned that our members will not be retirement-ready so we continue to invest in a wide range of education and engagement initiatives to promote long-term financial well-being.

Our Global Property & Casualty division reported an increase in net earnings when compared with the prior year. Our European entities have delivered pleasing growth in premiums and fee income and we remain optimistic about the prospects for significant further growth. Reported claims for the division were higher than the previous year due to a higher than normal occurrence of large motor, marine and liability claims, which were offset by a benign hurricane season in Bermuda. We view our Global Property & Casualty business as an exciting source of growth and diversification as we are well positioned to capitalize on the strong macro-economic growth forecast in our European territories.

During the year our high net worth wealth management affiliate, AFL, became a wholly owned subsidiary of the Group and was subsequently rebranded Argus Wealth Management Limited. Our focus is providing an excellent client experience, whilst delivering sound guidance through consultative relationships. With $1.2 billion in assets in discretionary and advisory mandates, very competitive performance and a client retention rate of 99 per cent, this will support growth, diversification and a stable source of fee income for the Group.

Our focus over the forthcoming year continues to be:

- Global Expansion: Argus is a global company with assets and partners all over the world. In these times of economic uncertainty, we will continue to invest overseas to enable us to bring profit back to Bermuda, to drive dividends, job creation and economic growth.

- Reducing the Cost of Employee Benefits Administration: As the cost of doing business continues to increase in employee benefits, we have made significant progress towards reducing the cost of back office administration, invested heavily in technology, selected market leading outsource partners and are streamlining the process of data management.

- Investing in Healthcare Innovation: Our on-going population health initiatives promote healthy lifestyles and provide access to leading edge medical treatments including stem cell and biologics. We are also collaborating with global specialists in diabetes management, population health and holistic health care to drive further improvements.

- Increasing Efficiency Through Digitisation: Through the development of a digital portal, customers will now manage their health and pensions transactions at any time of the day, better serving our customers and reducing cost.

- Optimising our Management Team: In line with our strategy to provide expertise as well as products and services, we are moving from a product focused structure to solutions focused, putting our clients at the heart of what we do.

Ms Hill concludes: "I would like to take this opportunity to thank the Argus team for their hard work and professionalism and most of all, my sincere appreciation to each Argus client and shareholder for their continued loyalty, support and confidence.

"We are making a change for good. Change that will make a short term loss for long term benefit, but which supports our strategy of placing Argus on the global stage able to provide sustainable, quality care for the community and a strong return for partners for all our futures."